How to read your Mortgage Redemption Statement

Your property could be repossessed if you don't keep up your mortgage repayments.

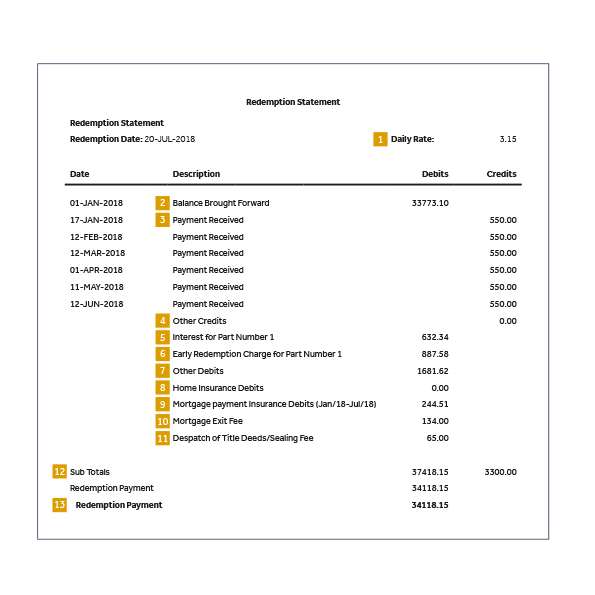

The Redemption Payment includes daily interest (referred to as the Daily Rate) up to the Redemption Date. If you redeem the mortgage on a different date to the Redemption Date shown, the Redemption Payment will be recalculated using the daily interest figure to increase or reduce the Redemption Payment by the number of days before or after the Redemption Date, or you can request an amended statement. If you do not redeem in the calender month specified on the Redemption Statement you will need to request a new redemption statement.

If you pay by direct debit we will automatically cancel this instruction once the redemption funds have cleared and the account is redeemed. Please note that if this mortgage is redeemed within five working days prior to the next direct debit collection date, we will not have sufficient time to cancel the direct debit. Where the direct debit has been collected after the mortgage has been redeemed, we will arrange a refund of the overpaid amount to be paid into your bank account within 10 working days.

This is the amount of interest that is added to your mortgage each day if you redeem your mortgage after the stated Redemption Date.

This is the balance that was outstanding on your mortgage at the end of the previous year in which you have made mortgage payments, brought forward to the 1st January of the year you request your redemption statement.

This shows the payments you have made from the 1st January of the year you request your redemption statement, up to the date the redemption statement was issued. Please note it takes 10 days for a direct debit to be included within this figure, so any recent payments may not be shown on your redemption statement. Any overpayments will be refunded within 10 working days following the Redemption Payment being paid in full.

This shows any refunds that have been sent to you from 1st January of the year you request your redemption statement, up to the date the redemption statement was issued.

This is the amount of interest that has been added to your mortgage from the 1st January of the year you request your redemption statement, up to the Redemption Date shown on your redemption statement. You will have already paid this interest as part of your monthly payments. If your mortgage has multiple Parts, the interest that has been added to each Part during this period will be listed.

This shows any charges that may be applicable if you are redeeming your mortgage within a fixed rate product period, unless you meet our criteria for porting. Whether these charges are applicable will be stated in your mortgage offer and product key features information. If your mortgage has multiple Parts, the Early Redemption Charge that has been added to each Part during this period will be listed.

This shows any other outstanding charges/fees applied to your account from 1st January of the year you request your redemption statement, up to the date the redemption statement was issued. This could include any of the charges/fees listed on our “tariff of mortgage charges” or any charges in respect of unpaid/returned payments from your Bank or Building Society (which will also be shown in the Credits column).

This section will always show as zero as we do not have any house insurance debits.

This shows any amounts which have been added to your account in respect of any mortgage payment protection insurance you have purchased through Leeds Building Society alongside your mortgage from the 1st January of the year your request your redemption statement, up to the date the redemption statement was issued.

This fee is payable if you redeem your mortgage before the end of the agreed mortgage term. This is also known as an Early Redemption Fee.

This fee is applicable if your title deeds are required by, and sent to your solicitor when redeeming your mortgage.

The sub-total under the Debit column is the total of the Balance Brought Forward, plus all interest, fees and other charges which have been added to your mortgage account up to the date the redemption statement was issued. This also includes any interest to be applied to your account up to the Redemption Date. The sub-total under the Credit column is the total of all of the payments that you have made and refunds that have been made to you from 1st January of the year you request your redemption statement, up to the date the redemption statement was issued.

This is the final figure that needs to be paid to redeem your mortgage on the Redemption Date shown on your redemption statement.