How to read your Mortgage Redemption Statement

Your property could be repossessed if you don't keep up your mortgage repayments.

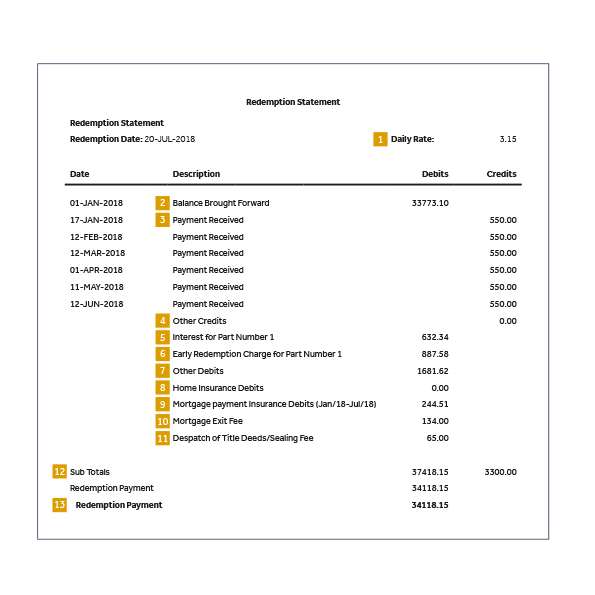

The Redemption Payment includes daily interest (referred to as the Daily Rate) up to the Redemption Date. If you redeem the mortgage on a different date to the Redemption Date shown, the Redemption Payment will be recalculated using the daily interest figure to increase or reduce the Redemption Payment by the number of days before or after the Redemption Date. Or, you can request an amended statement. If you don't redeem in the calendar month specified on the Redemption Statement you'll need to request a new Redemption Statement.

If you pay by direct debit we'll automatically cancel this instruction once the redemption funds have cleared and the account is redeemed. Please note that if this mortgage is redeemed within five working days prior to the next direct debit collection date, we won't have sufficient time to cancel the direct debit. Where the direct debit has been collected after the mortgage has been redeemed, we'll arrange a refund of the overpaid amount to be paid into your bank account within 10 working days.