Published: 28 July 2023

We’ve published our half-year financial results for 2023. These results show that we’re continuing to deliver on our purpose to put home ownership within reach of more people, generation after generation.

They also show that during a period when interest rates have continued to rise, we’re standing by and supporting both savings and mortgage members.

Read on for key highlights or look at our full half year results.

Nearly half of all our new mortgage members are first time buyers

We’re pushing ahead with our purpose, helping thousands onto and up the property ladder.

That’s why we’re proud to say that just under half (49%) of all our new mortgage members in the first half of the year were first time buyers - 7,700 of them.

The month of June was also our busiest ever for Shared Ownership mortgages, showing why we’ve won eight consecutive What Mortgage awards as a Shared Ownership provider.

Making home ownership dreams a reality for more people is what drives us forward, and we continued to focus on that aim in the first half of the year. Our new Home Deposit Saver is a unique savings product that supports those looking to take a first step onto the housing ladder. We're working collaboratively with Experian to use their Boost service which could increase the credit score of those about to apply for a mortgage. And our actions for change, outline the changes we're committed to making now and in the future.

Members are saving more money with us than ever

We simply wouldn’t exist without our savings members, and we helped 63,500 more people save for their future, which increased our savings balances to a record high (£19.1bn).

Each time the Bank of England base rate rose, we passed on the increase to our members with variable rate accounts to offer fair value across our range.

And we’ve continued to pay savers more than the average interest rate at 1.83% compared to the market average of 1.30%[i].

We've continued to support our members

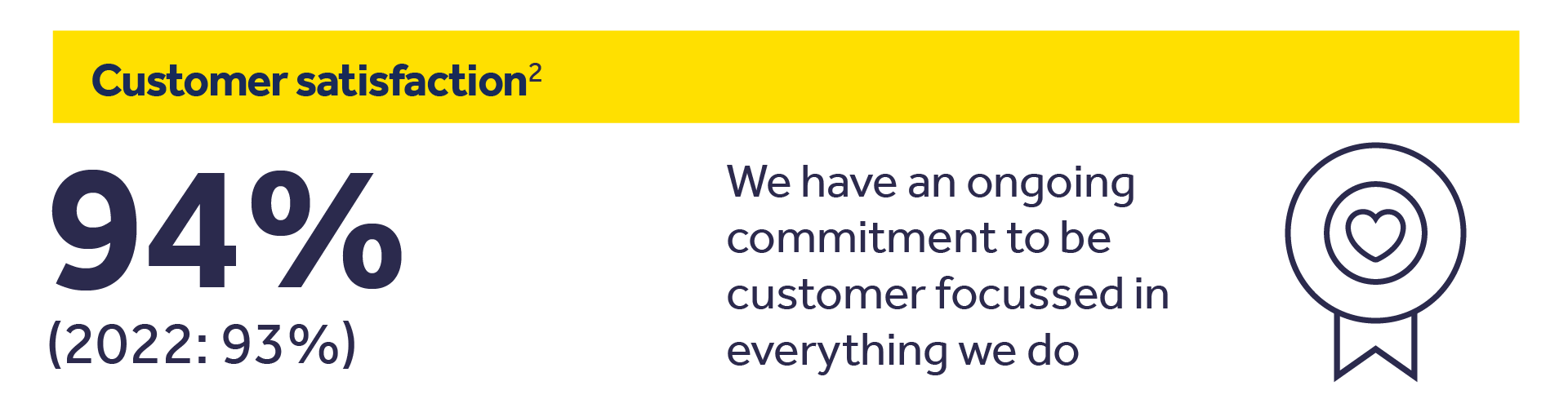

We’ve now got a record 878,000 members and our commitment to keeping them satisfied is as strong as ever. We know that without happy customers, we wouldn’t be able to deliver our purpose. Everything we do is with our members and members-to-be in mind, and we continue to invest in our technology to help our colleagues drive the best outcomes for members.

Our financial strength and security helps us be there for our members during difficult times, with total assets now worth £26.9bn (a Society record high), we can continue to support them in a variety of ways.[ii]

Raising even more money for the causes we believe in

We smashed our Dementia UK fundraising target of £500,000, and have taken our total beyond £700,000, due to amazing support from our colleagues and members. In 2023, we also donated £565,000 to a range of charitable causes both locally and nationwide.

We’re proud that so many mortgage and savers members have chosen us to help them in their ambitions, and we’re ready to push forward with our purpose for the rest of the year.

[i] We paid an average rate of 1.83% against the rest of the market average of 1.30%. CACI’s CSDB, Stock, June 2022 to May 2023, latest data available. CACI is an independent company that provides financial benchmarking data of the retail cash savings market.

[ii] Overall customer satisfaction in a survey of 1,770 members from January to June 2023.