Your statement

Here’s an example of a typical mortgage statement.

The blue numbers flag where the most important information is, and we've provided some further guidance on these parts underneath the example statement.

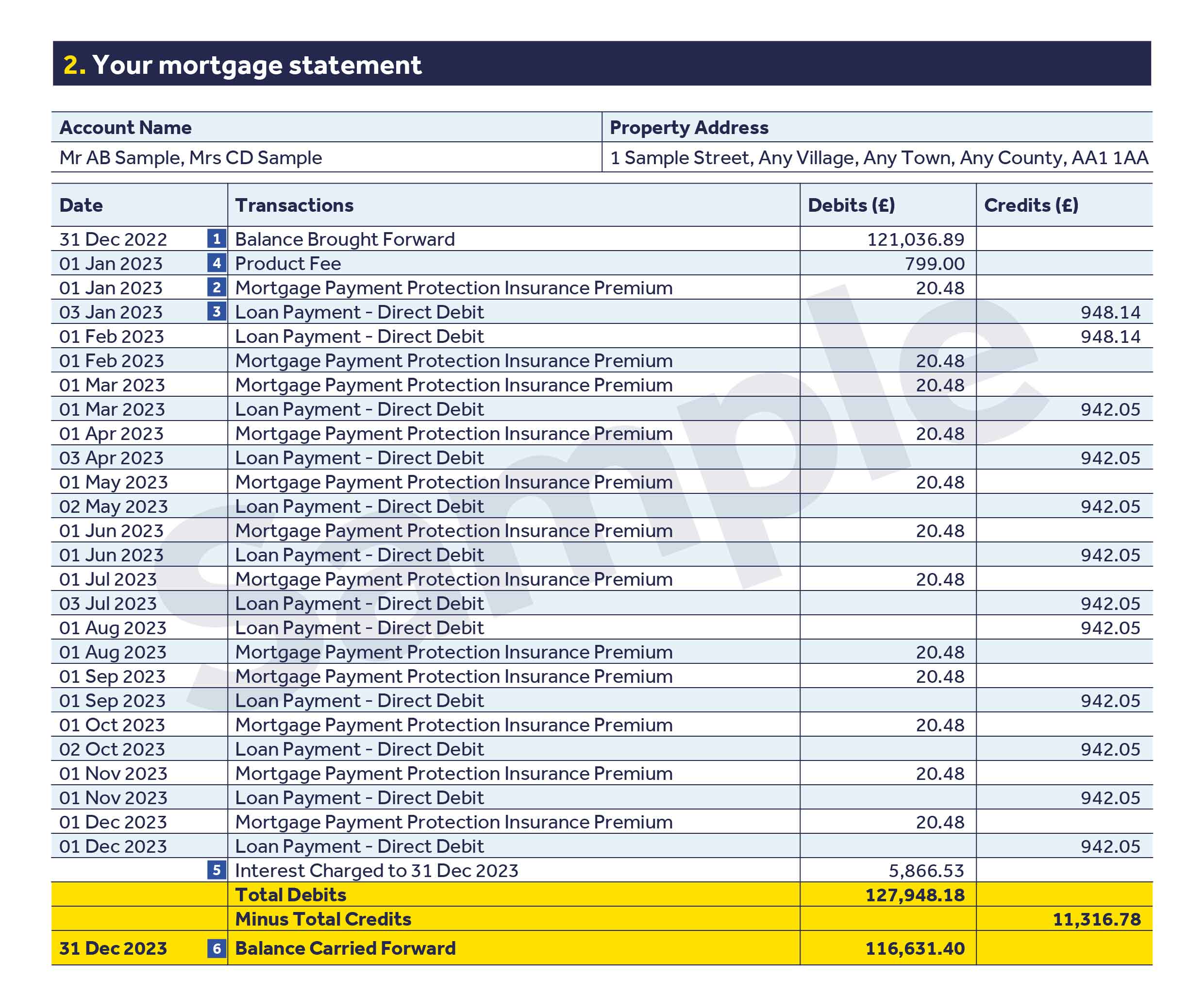

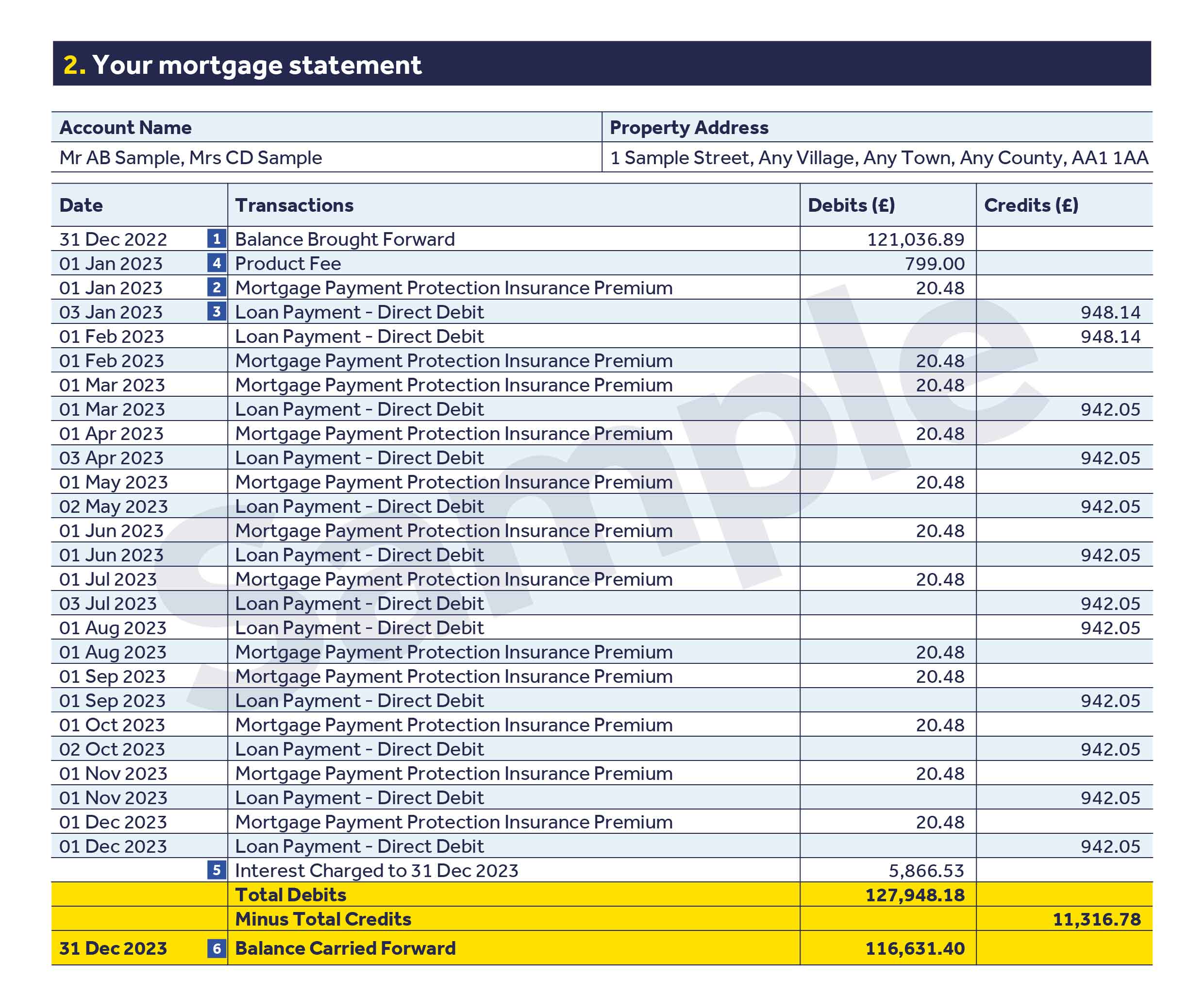

1. Balance brought forward

This is how much you still needed to pay on your mortgage product(s) as of 31 December 2022. If your mortgage started after this date, your start date and full loan amount will be shown here.

2. Mortgage Payment Protection Insurance Premium Payment

If you have Mortgage Payment Protection Insurance arranged through us, any premium(s) charged will be shown in the 'Debits' column. These premiums are paid with your monthly loan payments, as shown in the 'Credits' column.

3. Loan payment

The loan payments you've made will show in the 'Credits' column, while any refunds and returned or unpaid payments are shown in the 'Debits' column.

4. Fees

All fees and charges are shown in the 'Debits' column. Most of these items will include a short description, but you can look at our Tariff of Mortgage Charges for further details. Unless you make an additional payment to cover a fee, as shown in the example statement, the mortgage balance will increase.

5. Interest charged

This is the interest charged for the period from 1 January to 31 December 2023. It totals the interest applied to all parts of your account and considers any interest rate changes throughout the year. If you’ve made a lump sum capital payment or taken out any additional borrowing, the balance on your account will have changed, and will have affected the amount of interest charged.

6. Balance carried forward

This is how much you still need to pay as of 31 December 2023, including all debits and credits shown on your statement.

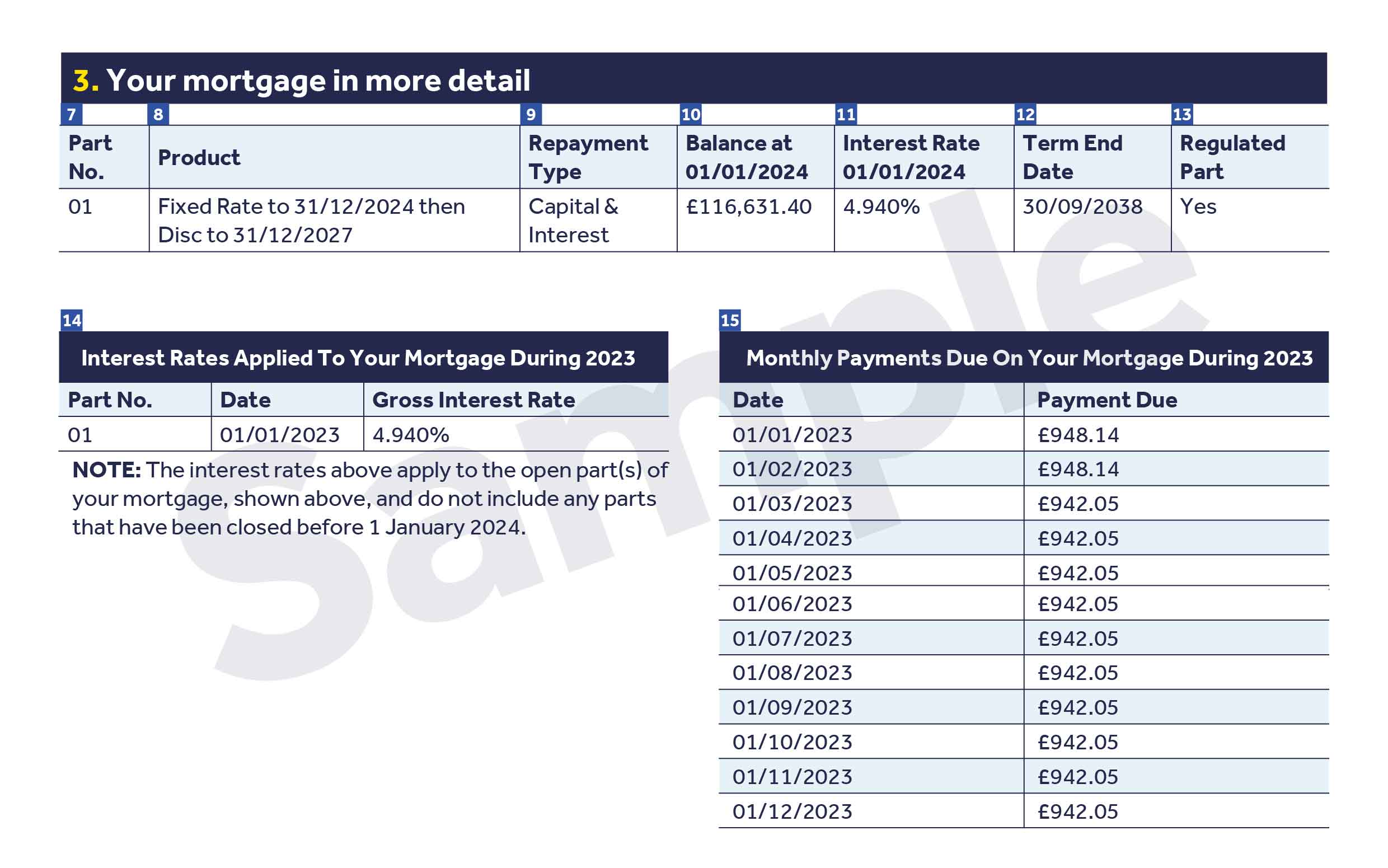

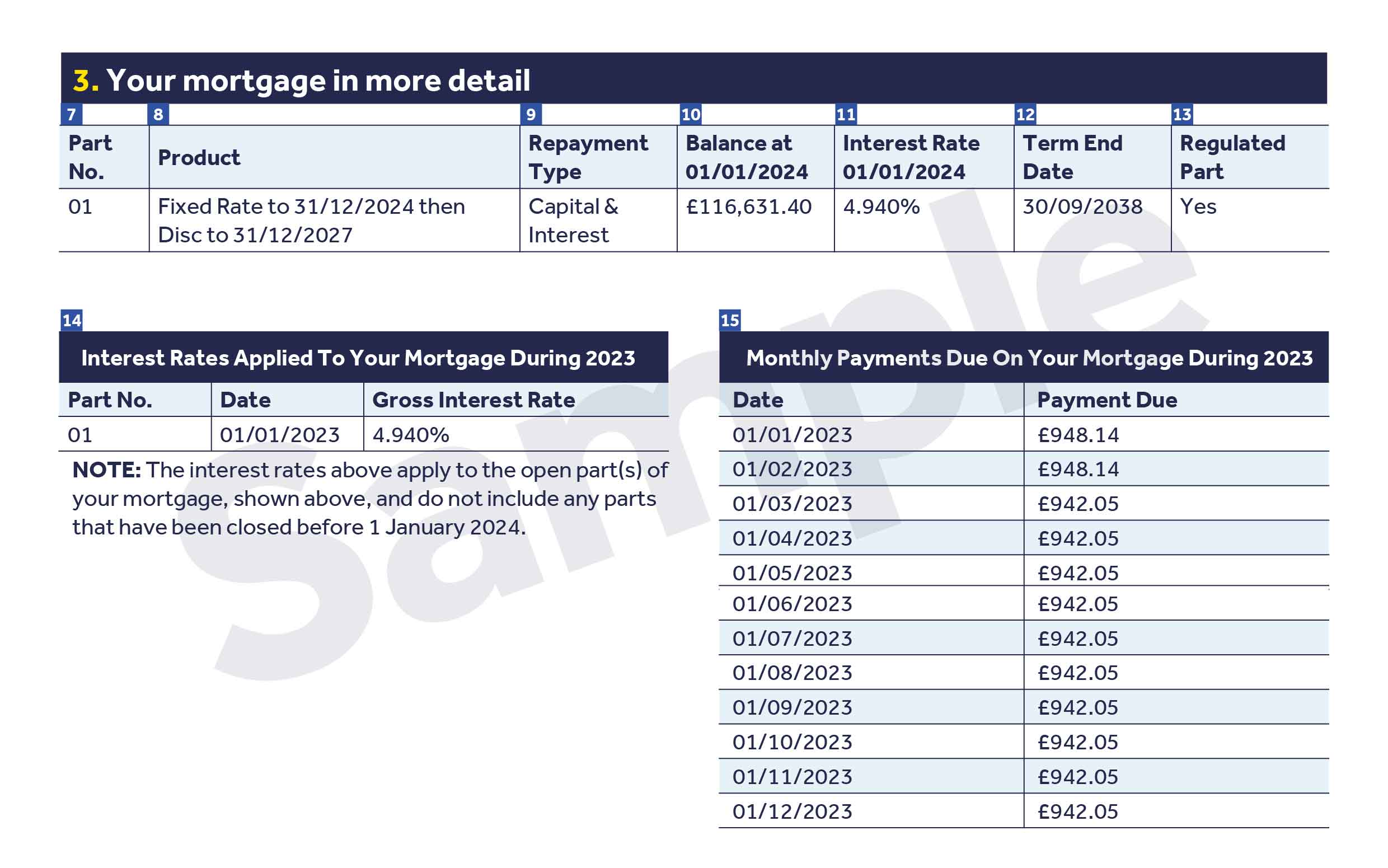

7. Part number

Your mortgage account may be made up of different parts, which have their own interest rate, repayment type and term. Each part will be given a number. You may have a mortgage with two or more parts that have differing details.

8. Product

This is the product you've chosen for each part of your mortgage.

9. Repayment type

This defines how the part shown will be repaid. Read the 'Your mortgage explained’ leaflet for more information about the different repayment types, particularly Interest Only. This was posted to you with your mortgage statement.

10. Balance

This is how much you still need to pay on each part of your mortgage as of 1 January 2024.

11. Interest rate

This is the interest rate for each part of your mortgage as of 1 January 2024.

12. Term end date

This is when each part of your mortgage is due to end. It’s also when you’ll need to make a lump sum payment to repay any Interest Only balance(s) in full, if applicable.

13. Regulated part

In the UK, the Financial Conduct Authority (FCA) is responsible for the regulation of Residential mortgages and certain Buy to Let mortgages taken out on or after 21 March 2016, which aren’t held by the borrower for business purposes. If your mortgage falls within this category, you’ll benefit from certain protections under the regulatory system.

14. Interest rates applied in 2023

This is the interest rate applied to each part of your mortgage between 1 January and 31 December 2023, and the dates any changes took effect. These interest rates only apply to part(s) of your mortgage that were open last year, and don’t include details for any parts closed before 1 January 2024.

15. Monthly payments due

These are all the payments that were due on your mortgage during 2023. These should be read alongside the payments you made, as seen in the 'Credits' column of your statement.

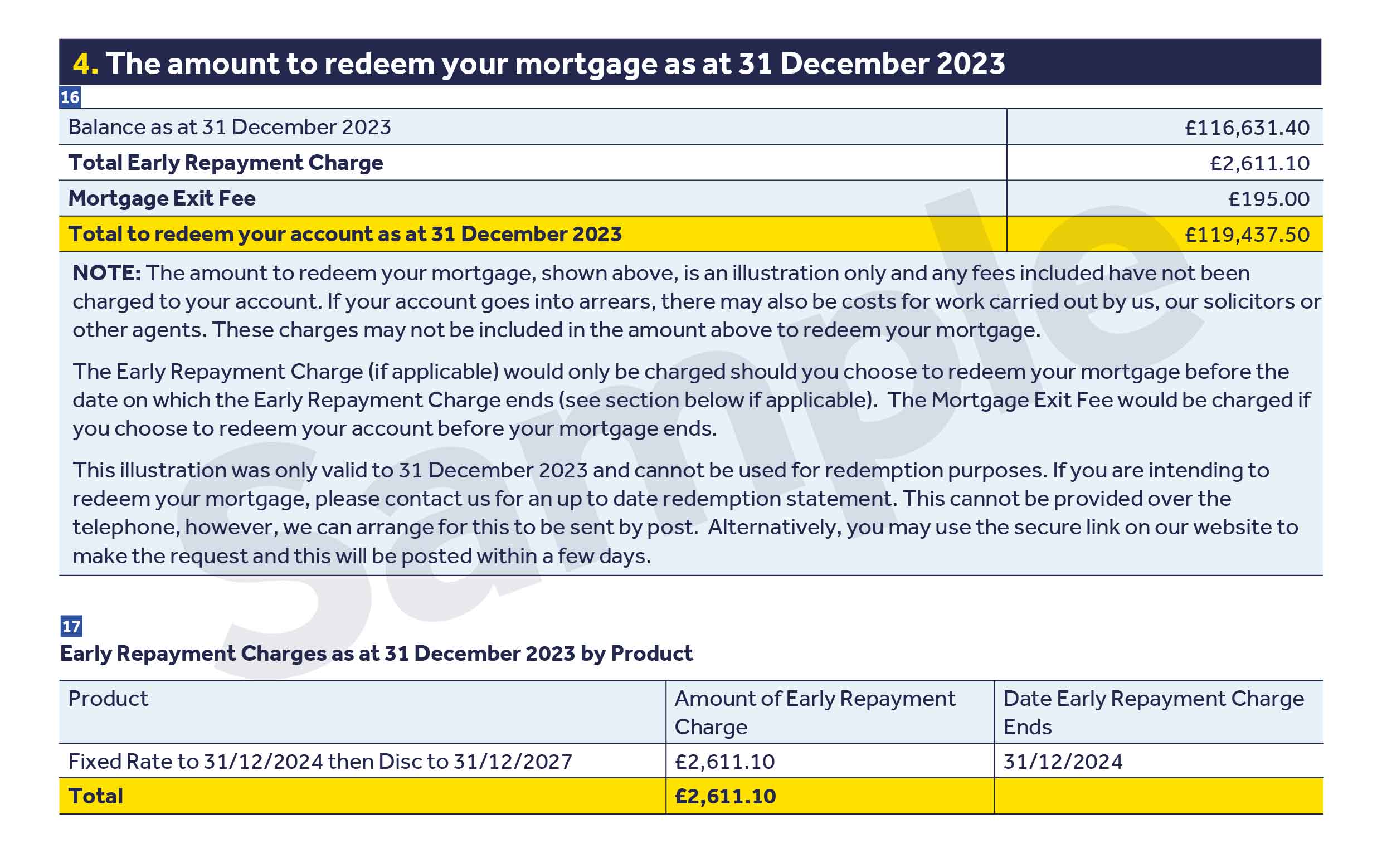

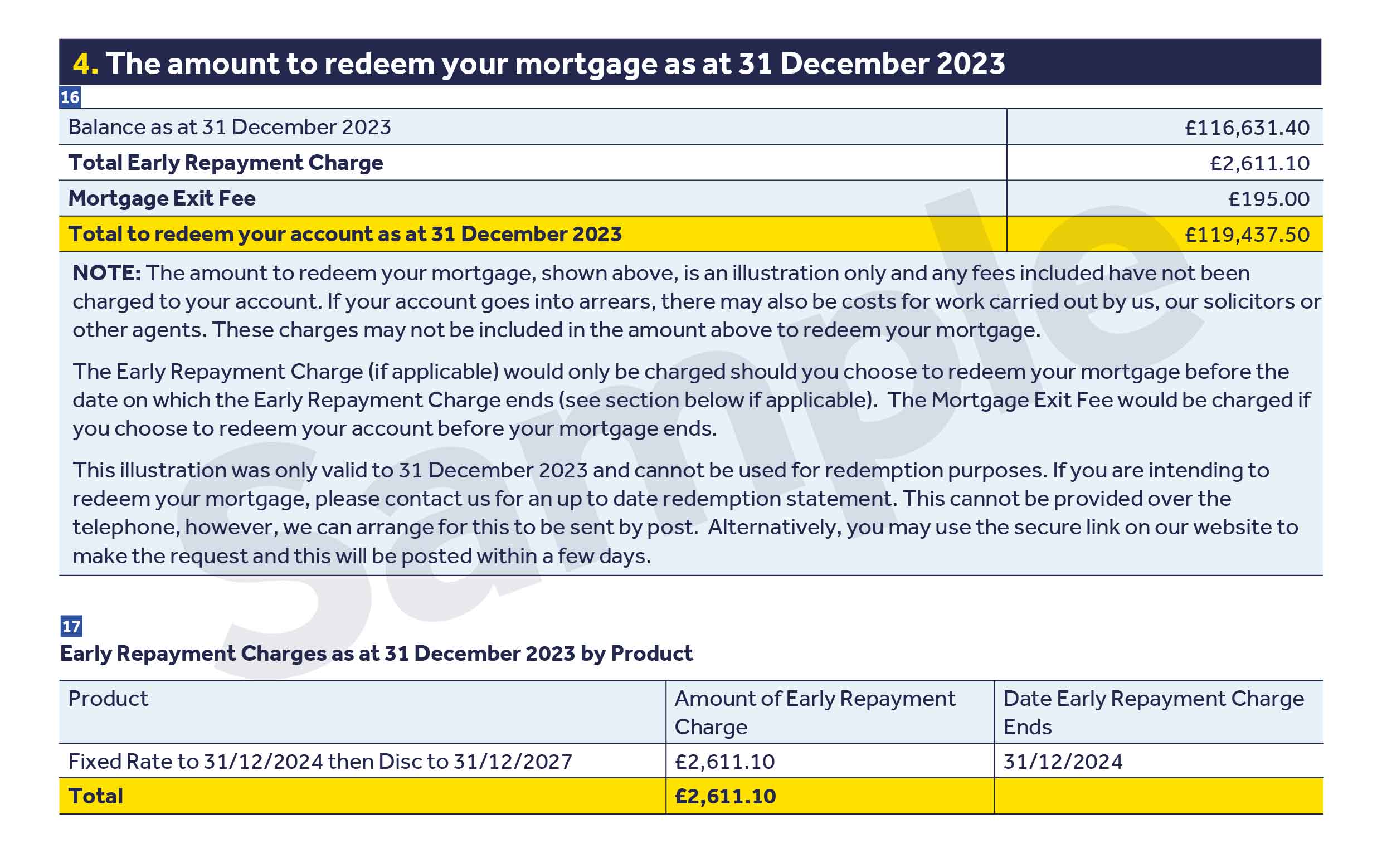

16. Amount to redeem mortgage

This was the amount required to pay your mortgage in full on 31 December 2023, and includes the balance at this date plus any possible repayment charges and exit fees. This is an illustration only. These fees haven’t been charged to your account and will only be charged if you choose to redeem your mortgage in the future.

This illustration was valid to 31 December 2023 and can’t be used for redemption purposes. If you want to redeem your mortgage, please contact us for an updated redemption statement.

17. Early Repayment Charges

This is the Early Repayment Charge, if applicable under the terms of your mortgage product(s), calculated as of 31 December 2023 for each product.

We’ve created a handy glossary of the most used mortgage terms for you online. We hope it makes things easier, but if you need more help when it comes to understanding your mortgage or your mortgage statement, please contact us.

Frequently asked questions

How will interest on my mortgage be worked out?

Your annual mortgage statement shows whether the interest on your mortgage is worked out daily or annually. It also shows whether your monthly mortgage payments will be reviewed and worked out once a year, or more than once a year. If the interest on your mortgage is worked out annually, you can move to daily interest when transferring to a new mortgage product (Early Repayment Charges may apply). But it’s not possible to switch from daily to annual interest.

Annual interest

This is where interest is worked out on your mortgage balance on the last day of the previous calendar year. With annual interest your monthly mortgage payments will not reduce the balance on which interest is charged until 31 December each year.

Daily interest

This is where interest is worked out on your mortgage balance at the end of each day. The interest is charged to your account daily, increasing the mortgage balance by the amount of interest. If the interest on your mortgage is worked out daily, making your mortgage payments as early as possible in the month will reduce the balance and the amount of interest charged.

How is my mortgage affected when interest rates change?

Depending on the type of mortgage you have, will depend on how your mortgage is affected by rate changes.

If your mortgage is part of the annual review scheme, your monthly payments won’t normally be amended when interest rates change (they usually only change on the annual review date, with the new payment taking effect from March). If you’d like your monthly payments to be recalculated, please contact us.

We’ll still write to you when interest rates change, confirming the new interest rate and effective date. Again, your mortgage payment won’t normally change until the annual review date. If interest rates increase, any underpayment of interest will be reflected in your new monthly payment, to be repaid over the remaining mortgage term. If interest rates reduce, any overpayment of interest will be subtracted from your mortgage balance, and your next monthly payment will be calculated based on the new outstanding balance.

If your mortgage isn’t part of the annual review scheme, your monthly mortgage payment will go up or down whenever there’s a change to your mortgage interest rate. Whenever your mortgage interest rate changes, we’ll write to you and tell you about the new interest rate, your new monthly mortgage payment and when this will take effect.

If you’re on our annual review scheme you can switch to our non-annual review scheme at any time by contacting us.

If you do decide to switch to our non-annual review scheme, you can’t return to the annual review scheme at a later date.

Why has my monthly payment changed?

Your monthly payment could change for a number of reasons, such as:

• Your mortgage has a variable rate that’s linked to our Standard Variable Rate (SVR) or the Bank of England base rate, and the rate of interest has changed. During 2022 the Bank of England increased the base rate of interest eight times. We made the decision to increase our standard variable rates three times – we wrote to you at the time if you were on one of our standard variable rates to tell you about these increases and how they might affect your mortgage.

• Fees have been debited to your mortgage

• You have Mortgage Payment Protection Insurance arranged as part of your mortgage, and your insurance has been reviewed/renewed.

• You’ve missed or underpaid any mortgage payments in the past year.

• Your mortgage currently operates on a fixed, discounted or tracker product that is due to end before the next review date.

Why has my mortgage balance increased?

Your mortgage balance could increase for a few reasons, such as:

• You’ve missed or underpaid any mortgage payments in the past year

• You’ve chosen to add some fees to your mortgage instead of paying them separately

• Your December payment didn’t reach us until January, so will only appear on the following year’s statement

How can I reduce my mortgage balance faster?

Some mortgages let you make overpayments that will reduce your mortgage balance. The most common ways to do this are by:

• Paying a higher amount than the monthly payment quoted

• Making a lump sum payment at any time

If your mortgage product has daily interest, either of these options will reduce your balance on which interest is charged straight away.

If your mortgage product has annual interest, to reduce your balance on which interest is charged straight away, any overpayment must be for £1,000 or more.

Subject to the terms and conditions of your mortgage, any overpayment could incur an Early Repayment Charge.

By how much can I overpay each year?

The amount of overpayments you can make each year without having to pay any fees or charges depends on the type of mortgage you have. The limit is usually 10% of the mortgage balance each year.

To find out how much you can overpay each year without fees or charges, see the terms and conditions in the mortgage offer you received when you took out your mortgage or contact us.

It’s worth knowing that making overpayments may mean you have to pay an Early Repayment Charge.

How do overpayments affect interest?

If your mortgage product has daily interest, either of these options will reduce your balance on which interest is charged straight away.

If your mortgage product has annual interest, to reduce your balance on which interest is charged straight away, any overpayment must be for £1,000 or more.

Can I change my Direct Debit payments?

Yes, If you’d like to change the date of your Direct Debit, please contact us . But the new date you choose must be between the 1st and the 25th of the month.

If your bank details change, you must set up a new Direct Debit for your mortgage payment. You can call us or complete a new Direct Debit instructions form at leedsbuildingsociety.co.uk/ddm. It can take up to 10 working days for the new Direct Debit to be set up, so bear this in mind.

What can I do if I think I'll have problems meeting my monthly payments?

As the cost of living continues to go up, we understand money worries may be on your mind. Rising bills or sudden, unexpected changes to your finances could mean you could struggle to pay your full monthly mortgage payment.

That’s where we can help. If you fall behind with mortgage payments – or are worried you might do – our dedicated teams are here for you. Together, we can work out what your best options are and which steps to take next.

Talk to us

Our friendly expert teams are just a call away on 0800 072 9739. The lines are open Monday to Thursday 8am-7pm, Fridays 8am-5pm, and Saturdays 9am-12.30pm. This number will be closed on bank holidays. If you’re not able to call us but you still have a concern, please email us at lbssecuremortgagesupport@leedsbuildingsociety.co.uk

What can I do if I have an Interest Only mortgage and I'm concerned about repaying my outstanding loan?

If you don’t have a repayment strategy in place to repay the mortgage balance at the end of the term, you should contact us as soon as possible to discuss your options before your mortgage comes to an end.

If you already have a repayment strategy, please make sure you regularly check that it’s still appropriate.

Can I let out my house if I have a mortgage?

We sometimes get questions from members asking us if they’re able to rent their house out to tenants if they have a mortgage. Depending on the type of mortgage you have, it may be possible for you to do this. The first step is to ask us to send you a Consent to Let pack.

This contains all the information you’ll need to make the request. We’ll then talk to you to see if it’s an option in your circumstances. To find out more visit leedsbuildingsociety.co.uk/mortgages/consent-to-let

What can I do if my mortgage is under the Deeds Safe Service and my balance has increased?

If your mortgage operates under this scheme, you should ensure that you maintain the small balance by paying any amounts due as set out in your statement. If the balance carried forward shown on your statement has increased due to any unpaid insurance, interest or fees in previous years, please contact us to discuss this and arrange to reduce the balance back to a small amount.

It’s recommended that you regularly review whether the Deeds Safe Service continues to meet your needs. You can repay the outstanding balance and close your mortgage account if you no longer require this service. If you’d like to do this, please contact us so we can let you know the exact amount that you need to pay. We suggest that you seek professional advice to discuss your options.

Is there anywhere I can receive independent advice on my mortgage payments?

Yes, there are several options available to you for independent advice:

• MoneyHelper www.moneyhelper.org.uk. This is a free service that provides clear, unbiased advice to help you make informed choices.

• Citizens Advice www.citizensadvice.org.uk. They provide free, independent, confidential and impartial advice.

• Independent Financial Advice

Any further questions?

Simply contact us and we’ll see what we can do to help.